As the issue of new energy consumption becomes more and more urgent, energy storage practitioners pay more attention to the construction of new power systems than anyone else. Is the role of new energy storage in consumption really as worthless as what the academician said, that is, “Yangtze River water is used to fill a few mineral water barrels”?

However, players in the energy storage industry firmly believe that new energy storage will act as a “voltage stabilizer” for the power grid and a “green electricity bank” for users.

Is energy storage a “mineral water bucket” or a “green electricity bank”? First, we need to ask the power system.

With the rapid transformation of the global energy structure and the increasing proportion of clean energy power generation, the urgency of upgrading the power system has long been “urgent”. Before the peak of electricity consumption this summer, many industrial provinces once again fell into “supply anxiety”, but power outages and power cuts still inevitably occurred in Sichuan and other places.

So with more and more new energy sources that “depend on the weather” being connected, how can China’s urban power system achieve flexible and stable scheduling? In terms of auxiliary power grid peak and frequency regulation, in addition to coal-fired power and pumped storage, the most imaginative space is new energy storage.

The value of energy storage must be defined in the grid

How urgent it is to upgrade the power grid system depends on two aspects.

According to Shen Yijun, a German power grid digitization research expert and German energy economics analyst, told the media, “To measure whether the stability of the power grid adapts to the low-carbon power structure, two important indicators need to be looked at. First, the installed capacity of new energy power generation accounts for 1% of the total power generation capacity. The second is the proportion of new energy power generation in the overall power generation.”

Let’s take a look at China’s current data: Data from the National Energy Administration’s mid-year press conference in July this year show that by the end of June 2024, the country’s installed renewable energy power generation capacity reached 1.653 billion kilowatts, accounting for approximately 53.8% of China’s total installed power generation capacity; during the same period, Renewable energy power generation (1.56 trillion kilowatt-hours) accounted for 35.1%; among them, wind and photovoltaic power generation (a total of 900.7 billion kilowatt-hours) accounted for approximately 20% of all power generation, with a year-on-year growth rate of approximately 23%. According to this growth rate, the proportion of wind and solar power generation will continue to rise rapidly in the future.

Taking Germany, which has a high level of power grid intelligence, as an example, Shen Yijun said that the proportion of new energy power generation in Germany has reached 51.8% in 2023. In fact, long before this indicator was reached, the German power grid was under traditional conditions. The transmission and distribution system has achieved high stability. However, as the proportion of new energy power generation has increased rapidly in the past 20 years, it has posed greater challenges to maintaining the original stability, especially from economic considerations, which requires the German power grid to further deepen its digital and intelligent transformation.

At the same time, local photovoltaic distribution and storage in Germany has also gained popularity. According to public reports, as of August 2023, the penetration rate of local photovoltaic distribution and storage in Germany has exceeded 20%. Moreover, the photovoltaic distribution and storage in the German market is relatively economical, with an IRR of 18.58% and an investment payback period of 6.203 years. This has stimulated its household storage market to continue to be hot in 2023, with the installed capacity in the first half of the year exceeding the total in 2022.

Therefore, the value of energy storage must be defined in the context of new energy systems and new power systems.

As Tian Qingjun, senior vice president of Envision Group and president of Envision Energy Storage, said, in China, energy storage is also becoming a “new growth pole” for the development of new energy sources such as wind power and photovoltaics.

Energy storage installed capacity is still growing rapidly. According to industry reports, China’s newly commissioned new energy storage capacity will reach 21.5GW/46.6GWh in 2023, with both power and energy scale increasing by more than 150% year-on-year, three times the level of newly commissioned capacity in 2022. This growth rate exceeds the growth rate of newly installed photovoltaic and wind power capacity in the same period. In the future, it will be normal for energy storage installed capacity to grow faster than wind power and photovoltaics.

To achieve the dual carbon goals, China needs at least 10 billion kilowatts of wind power and photovoltaic installed capacity, which has just exceeded 1.2 billion kilowatts, with huge space and potential. However, as the penetration rate of wind power and photovoltaic power generation has reached 20%, it is close to the limit that the power grid can bear, which poses a huge challenge to the safe and stable operation of the power grid. For the power system to be compatible with a high proportion of wind power and photovoltaics, large-scale storage is inevitable. If wind and solar power are to continue to develop, energy storage must come first.

However, it is important to face the fact that the main driving force behind the last round of energy storage capacity expansion was the allocation of new energy to storage. Academician Liu Jizhen, who publicly criticized that “new energy storage has basically played no significant role in large-scale new energy consumption”, actually said the second half of the sentence – the application of new energy storage on the demand side is far better than on the source and network side.

So when will the development of new energy storage no longer rely on the “strong allocation” of new energy? The answer to this question depends on whether the new energy storage power station can independently realize profits.

The premise for energy storage to be profitable is the reduction of the cost per kilowatt-hour

Tian Qingjun predicted in his speech at the opening ceremony of the 11th China International Solar Storage and Charging Conference that “2025 will be a watershed for the energy storage industry. In other words, energy storage is expected to achieve independent profitability in some provinces next year.”

This prediction is based on two logics. The first logic is the decline in energy storage prices and the cost per kilowatt-hour; the second logic is based on the openness of the power market, especially the power spot market.

Since the middle of last year, the energy storage industry has ushered in a wave of price cuts. The bidding and winning prices of energy storage systems have continued to decline; this year, their prices have further dropped. Data shows that at the beginning of this year, the winning price of energy storage systems in the large storage market was still around 0.8 yuan/Wh, but the current price has dropped to around 0.5 yuan/Wh.

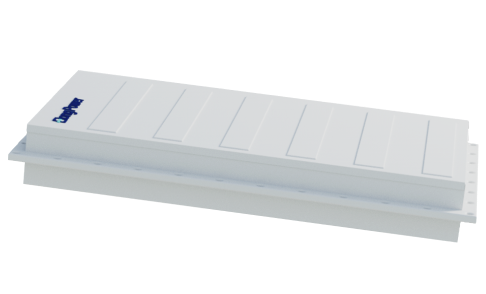

At the just-concluded third EESA Energy Storage Exhibition, energy storage manufacturer Kelu Electronics launched new industrial and commercial energy storage products and quoted a low price of 0.598 yuan/Wh, refreshing the previous lowest price in the industrial and commercial market (0.72 yuan/Wh).

The decline in prices in the energy storage industry is mainly due to the iterative upgrades promoted by energy storage system integrators through technological innovation and refined management, which has greatly reduced the cost of energy storage products.

In order to quickly reduce the cost of energy storage products on the one hand and ensure profits on the other hand, the use of large-capacity batteries to increase the single energy density of energy storage products has become an important method.

The most direct manifestation is that since 2024, large-capacity and high-energy-density energy storage products have been released one after another, and records have been broken: in April, CATL officially released the 6.25MWh Tianheng energy storage system, entering the 6MWh era; in June, Lanjun New Energy launched a 7.03MWh energy storage system, continuing to push up the capacity level; and at the EESA Energy Storage Exhibition, Envision Energy Storage officially launched the 8MWh container system, and the “world’s largest capacity energy storage system” was born, and the energy storage industry entered the 8MWh era.

The Envision 8MWh container system uses 700Ah large battery cells, with an RTE of 96%, a capacity density of 440+Wh/L, and a cycle number of over 15,000 times. This plays a key role in Envision’s energy storage capacity exceeding 8MWh in a 20-foot container. The larger the capacity of a standard 20-foot container, the higher the energy density and the lower the cost per kilowatt-hour.

Envision Energy launched an 8MWh container system at the 3rd EESA Energy Storage Show

The energy density of energy storage is getting higher and higher, which not only creates a downward trend in the price per kilowatt of energy storage itself, but also creates a downward trend in other electricity prices of the entire power station, such as cables, BOT, land area, land acquisition area, etc., which makes the overall cost per kilowatt-hour of energy storage systems decline.

The essence of energy storage transactions depends on the electricity spot market

What is the ultimate development form of energy storage in the future? First, we must understand that “the essence of energy storage is trading.”

Energy storage can not only be a “voltage stabilizer” on the grid side, but also a “green electricity bank” on the user side. In the scenario where a high proportion of new energy is connected to the grid, energy storage will become a “voltage stabilizer” for the grid, not only helping the grid to adjust the frequency and peak, but also having the function of building a network to support the safe and stable operation of the new energy system.

In addition, the most important scenario for the value of new energy storage in the future is to participate in electricity spot market transactions.

For example, industrial and commercial owners can use the trading rules of the spot market to allow the already operated energy storage power stations to conduct peak-valley arbitrage, and the stored green electricity can achieve profitability through a charging and discharging model. This model is very close to the concept of a “green electricity bank”.

The possibility of energy storage participating in spot trading depends on the further opening of the electricity market.

As early as January 2022, the National Development and Reform Commission and the National Energy Administration clearly mentioned in the “Guiding Opinions on Accelerating the Construction of a National Unified Electricity Market System” that by 2030, the overall goal of achieving full participation of new energy in market transactions will be achieved. Since then, the pace of domestic new energy entering the market has significantly accelerated.

The “China New Energy Power Generation Analysis Report 2024” shows that in 2023, the domestic new energy market-based trading electricity will be 684.5 billion kWh, accounting for 47.3% of new energy power generation. The proportion of new energy participating in the spot market of some large power generation companies has exceeded 50%.

Today, after many years of pilot projects in many provinces and cities, the domestic electricity spot market is gradually turning positive. On September 5, the Gansu Province electricity spot market turned positive, becoming the fourth spot market to turn positive. The industry generally believes that the time for domestic new energy to fully participate in electricity market transactions may be advanced.

As long as you participate in the spot market, it is equivalent to opening up a new “income channel” for energy storage, and profitability issues will be comprehensively improved.

Tian Qingjun said in an interview with China Energy Network, “In the past, everyone’s understanding of the value of energy storage was limited to peak and frequency regulation. But we believe that energy storage is essentially a transaction, and its biggest and most core value creation is to carry out peak-valley arbitrage in the electricity spot market.”

Green electricity will enter the electricity spot market in the future. The biggest change is that green electricity will be “priced by the market” (in the past, it was fully guaranteed to be purchased at the benchmark price), and the most core factor is also the electricity price.

Therefore, Tian Qingjun judged that energy storage will be more profitable than wind power and photovoltaics in the future. He believes that after wind power and photovoltaics are all in the spot market in the future, according to current forecasts, China is expected to have a total installed capacity of 3 billion kilowatts in 2030, and 300 million kilowatts will be built every year in the future. By 2030, China will have such a large-scale wind power and photovoltaics all entering the electricity spot market. Based on market regulation, the electricity price pressure of green electricity is “not ordinary”.

After green electricity enters the market, the volatility and uncertainty of electricity prices will bring energy storage users entering the market